Within the system, you create an Invoice by entering a Transaction. This may be done from the Diary or from the patient's Account screen.

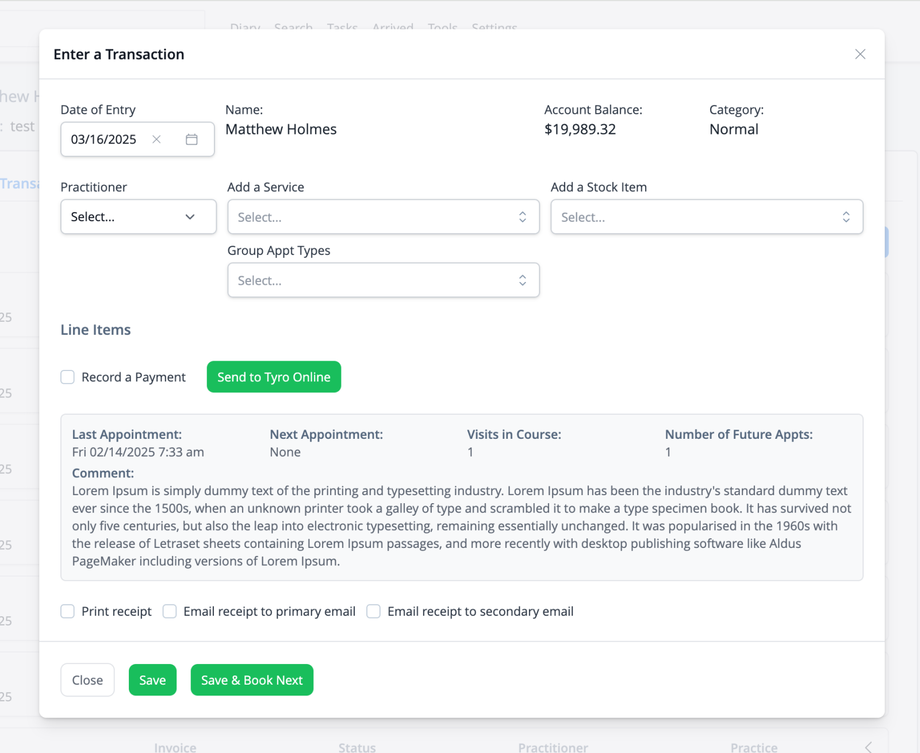

To enter a Transaction from the Diary, click on an individual or group appointment. For an individual appointment, click the Transaction button. For a group appointment, click the Pay link. To enter a Transaction from the Account screen, click the "Enter transaction" button. In all cases you will see a modal lightbox like this:

If you are entering the Transaction from the Diary, the practitioner and a line item corresponding to the appointment type will have been pre-entered. The following can be modified:

- Date of Entry: the date to which the Transaction will be allocated. Defaults to the current date. Adjust for pre- or post-dated entries.

- Practitioner: the practitioner to which the Transaction should be allocated

- Add a Service/Group Appt Types: select an individual service or group appointment type to add to the invoice.

- Add a Stock item: Add stock line items to the invoice.

- Record a Payment: enter a payment for the invoice at the time of entry.

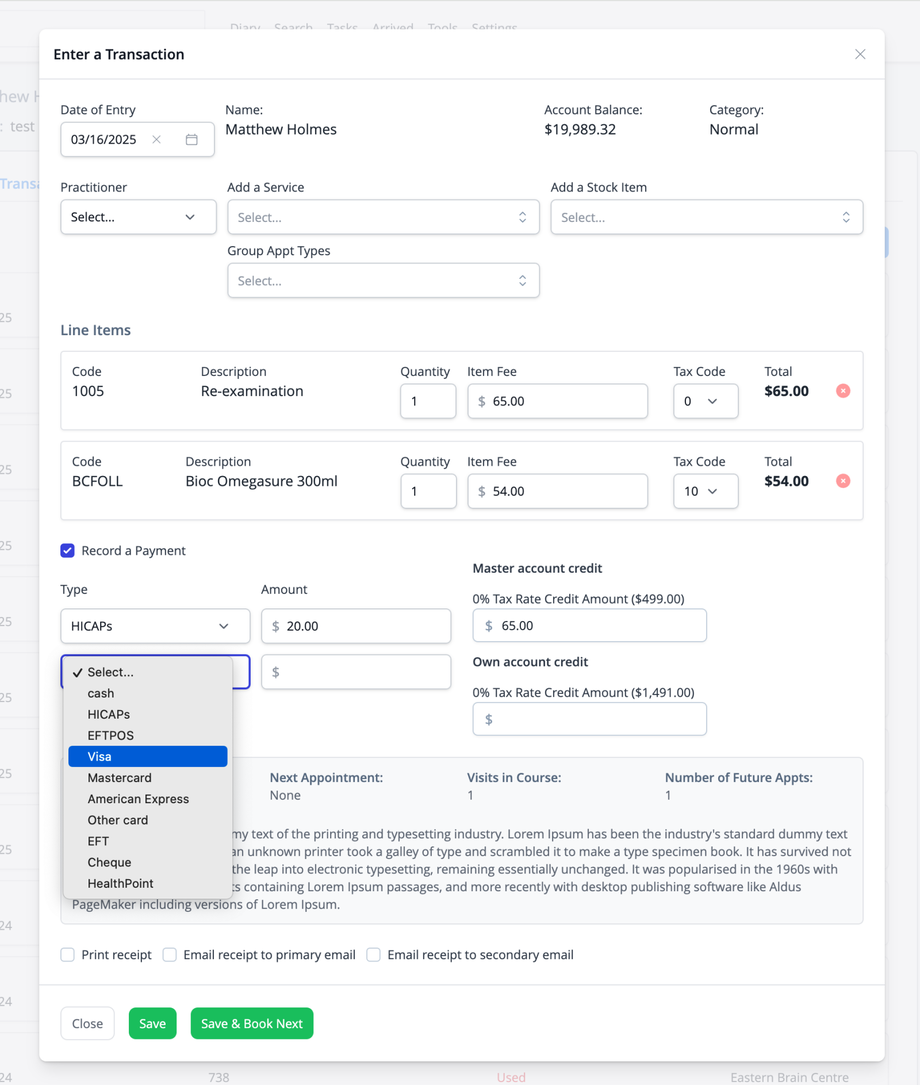

If entering a payment, tick the Record a Payment checkbox and enter the details for the payment.

If you need to enter a part-payment (such as a health insurance rebate) before paying the balance with account credit. Enter the part-payment by selecting the payment type and then editing the amount from the options on the left, then click in the field for the credit payment on the right. The system will calculate the remaining balance.

To email or print a receipt for the Transaction, tick the respective boxes.

To finalise the Transaction and create the invoice, click Save, or "Save & Book Next" if you wish to enter another appointment for the patient in the Diary.

Using Credits

For tax purposes, when entering credits, the tax rate must be set at the time of entry. As such, credits can only be used again line items that have a matching tax code. For example, treatments services may have a zero percent tax rate, while stock may have a ten percent tax rate. Any credit entered with a zero percent tax rate would therefore only be able to be used against treatment services, and not stock. While this may be inconvenient, it ensures your records are accurate for tax reporting.

To use a part of a credit against a line item with a different tax rate, you would need to create a partial refund of the credit via the patient's Account screen. You would then re-enter the partial refund amount with the required tax rate, at which point it will now be available to use for the Transaction.

Alternatively, most practices simply have the patient pay for incidental stock items as a separate payment entry rather than using credit.