Overview

The Tax Codes section allows you to configure different tax rates that can be applied to products in your inventory. This feature helps ensure correct tax calculations on invoices and reports.

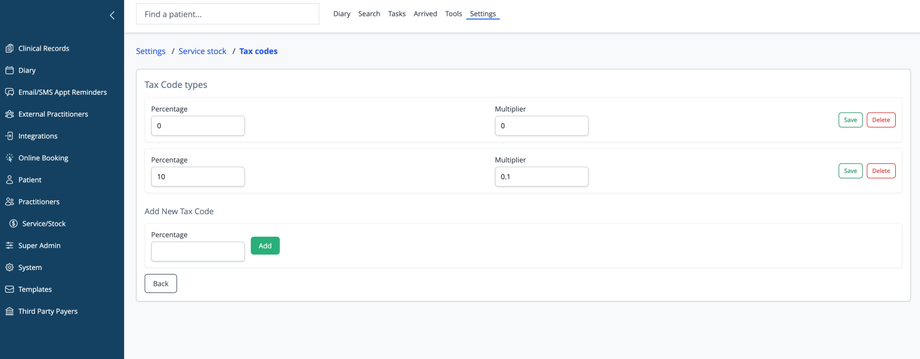

Tax Code Types

The system displays a list of all configured tax codes with their associated details:

- Percentage: The tax rate percentage (e.g., 0%, 10%, 15%)

- Multiplier: The decimal value used for calculations (automatically calculated)

Each tax code entry includes:

- Save button: To save any changes made to existing tax codes

- Delete button: To remove a tax code from the system

Current Tax Codes

The standard system comes with default tax codes based upon your country. E.g:

- 0% (multiplier: 0) - For tax-exempt or zero-rated items

- 10% (multiplier: 0.1) - For standard taxable items

Adding New Tax Codes

To add a custom tax rate:

- Scroll to the Add New Tax Code section

- Enter the desired percentage in the Percentage field

- For example, enter "15" for a 15% tax rate

- Click the Add button

- The system will automatically calculate the appropriate multiplier

- For example, 15% will generate a multiplier of 0.15

Note: You only need to enter the percentage value. The multiplier will be calculated automatically by the system.

Editing Tax Codes

To modify an existing tax code:

- Update the percentage value in the Percentage field

- Click the Save button next to that tax code

- The multiplier will automatically update based on the new percentage

Deleting Tax Codes

To remove a tax code:

- Click the Delete button next to the tax code you wish to remove

- Note that you cannot delete tax codes that are currently assigned to stock items

Integration with Stock Management

The tax codes configured in this section will be available for selection when adding or editing stock items. Each product in inventory can be assigned a specific tax code based on applicable tax regulations.

Navigation

- Back: Return to the previous screen without making changes

Best Practices

- Create specific tax codes for different categories of products based on your local tax regulations

- Regularly review tax codes to ensure compliance with current tax laws

- Use descriptive naming conventions if your region has multiple tax categories

- Consider tax exemption status for different product types